Top Strategies for Finding Low-Cost Car Insurance in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines

Discover effective strategies to find affordable car insurance in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines. Learn how to save on premiums and get the best coverage for your budget.

Finding affordable car insurance can be a challenge, especially if you’re new to the process or have a specific budget in mind. Fortunately, with the right strategies and a bit of research, you can uncover significant savings. This article will guide you through the best strategies for securing low-cost car insurance in cities like Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines. We’ll cover tips for comparing quotes, understanding coverage options, and choosing a policy that fits your budget, along with relevant statistics and examples to illustrate potential savings.

1. Compare Car Insurance Rates Online

One of the most effective ways to find the best auto insurance rates is to compare car insurance rates online. Many insurance companies offer online tools that allow you to quickly compare quotes from various providers. This can save you time and effort by aggregating multiple quotes in one place.

For example, a study by the National Association of Insurance Commissioners (NAIC) found that drivers who used online comparison tools saved an average of 10-20% on their premiums. By comparing quotes from different insurers, you can identify the most competitive rates and find potential savings.

2. Leverage Discounts and Special Programs

Insurance companies often offer a range of discounts that can help reduce your premiums. Here are some common discounts to look for:

- Multi-vehicle car insurance discount: If you insure more than one vehicle with the same provider, you can often get a discount.

- Low-mileage car insurance: If you drive fewer miles than the average driver, some insurers offer reduced rates.

- Auto insurance discounts for military: Active duty military personnel and veterans may qualify for special discounts.

- Teen car insurance quotes: Some insurers offer discounts for young drivers who maintain good grades.

In Louisville and Grand Rapids, for instance, drivers who take advantage of these discounts can see significant reductions in their premiums.

3. Understand Coverage Options

Choosing the right coverage is essential for finding affordable car insurance. Here’s a breakdown of common coverage options:

- Liability-only car insurance: This is the minimum coverage required by law in most states and is typically the cheapest option. It covers damages to others but not your vehicle.

- Full coverage auto insurance: This includes liability coverage plus comprehensive and collision coverage, which protects your vehicle from damage and theft. While more expensive, it provides greater protection.

- High-risk auto insurance: For drivers with a poor driving history, high-risk insurance is necessary but often comes at a premium.

If you’re looking for cheap car insurance for new drivers or senior citizen auto insurance, be sure to compare different types of coverage to find the best fit for your needs.

4. Consider Pay-Per-Mile Car Insurance

If you drive infrequently, pay-per-mile car insurance can be a cost-effective option. This type of policy charges you based on the number of miles you drive, making it ideal for low-mileage drivers. In cities like Oklahoma City and Des Moines, where driving distances may vary, this can be a great way to save on premiums.

5. Explore Non-Owner Car Insurance Policy

If you don’t own a vehicle but frequently drive borrowed or rented cars, non-owner car insurance policy provides liability coverage when driving vehicles that aren’t yours. This can be a more affordable option if you only need coverage sporadically.

6. Utilize Online Auto Insurance Comparison Tools

Using online auto insurance comparison tools can streamline the process of finding the best rates. Websites and apps that aggregate quotes from multiple insurers help you see various options side-by-side. For example, a tool might show you quotes for commercial auto insurance as well as personal policies, helping you choose the most economical option.

7. Look for No-Deposit or No-Down Payment Auto Insurance

Some insurers offer no deposit car insurance or no down payment auto insurance, which allows you to start your coverage without an upfront payment. This can be particularly useful if you’re looking for affordable options in cities like Lansing, where upfront costs can be a concern.

8. Consider Temporary and Classic Car Insurance

For short-term needs, temporary car insurance offers coverage for a limited period, such as when borrowing a car or driving a rental. On the other hand, classic car insurance is designed for owners of vintage vehicles and often comes with specialized coverage and discounts.

9. Review Coverage for High-Risk and Specialty Vehicles

If you own a high-risk vehicle or have a history that might affect your rates, such as needing SR-22 insurance, make sure to compare quotes that reflect these factors. Similarly, electric car insurance or commercial auto insurance might have different rates and benefits that can impact your overall cost.

10. Consider Car Insurance for Bad Credit

If you have a less-than-perfect credit history, you might face higher premiums. Look for insurers that offer auto insurance for bad credit or check if improving your credit score could qualify you for better rates.

11. Evaluate Accident Forgiveness and Low-Mileage Policies

Some insurers offer accident forgiveness auto insurance, which can prevent your first accident from affecting your premium. Additionally, low-mileage car insurance is a viable option for those who drive less frequently.

Example Savings and Statistics

To illustrate potential savings, let’s consider an example. A driver in Des Moines who switches from a standard policy to a pay-per-mile car insurance plan might save up to 30% on their annual premium if they drive significantly fewer miles than the average driver. Similarly, using a multi-vehicle car insurance discount in Grand Rapids could result in savings of 15-25% when insuring multiple cars with the same provider.

Finding low-cost car insurance in cities like Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines involves a combination of comparing rates, understanding coverage options, and leveraging discounts. By utilizing online tools, exploring different policy types, and taking advantage of available discounts, you can find a policy that fits your budget without compromising on coverage.

How to Reduce Car Insurance Costs for Families: A Comprehensive Guide

Navigating the world of car insurance can be complex, especially for families managing multiple vehicles and varying insurance needs. Understanding how to secure the best auto insurance rates while taking advantage of discounts and policy options can result in substantial savings. This guide provides practical advice on finding low-cost car insurance, combining policies, and leveraging family-oriented discounts.

1. Compare Car Insurance Rates

The first step to finding affordable car insurance is to compare car insurance rates from various providers. Each insurance company has different pricing models, so it's crucial to shop around. Use online tools to get car insurance quotes online and evaluate the options available.

For example, if you're looking for cheap car insurance for new drivers in Louisville or car insurance for young drivers in Grand Rapids, comparing rates can help you find the most cost-effective policy. Make sure to consider both full coverage auto insurance and liability-only car insurance, depending on your needs.

2. Combine Policies for Savings

Bundling multiple insurance policies can lead to significant savings. Many insurers offer discounts for multi-vehicle car insurance and combining home and auto insurance. For instance, if you have three cars, combining their policies under one insurer could result in a multi-vehicle car insurance discount.

In cities like Oklahoma City and Lansing, where insurance rates might be more competitive, this can be particularly advantageous. Additionally, combining policies can simplify management and reduce overall costs.

3. Take Advantage of Family-Oriented Discounts

Many insurance providers offer discounts specifically for families. These can include:

- Accident forgiveness auto insurance: This prevents your rates from increasing after your first accident.

- Auto insurance discounts for military: If you're a military family, you may qualify for special discounts.

- Senior citizen auto insurance: For families with older drivers, some insurers offer lower rates for senior citizens.

- Teen car insurance quotes: Insurers often provide discounts for adding a teen driver to a family policy, especially if they maintain good grades or complete a driving course.

For example, in Des Moines, you might find auto insurance discounts for military that can reduce costs if you're part of a military family.

4. Utilize Low-Cost Insurance Options

Explore various low-cost car insurance options to find the best fit for your family:

- Pay-per-mile car insurance: Ideal if you don't drive frequently. This can be a great option for families with low mileage vehicles.

- No deposit car insurance and no down payment auto insurance: These options can be useful for managing your cash flow while still maintaining coverage.

- Temporary car insurance: If you need coverage for a short period, this can be a more economical choice.

In cities like Louisville, where many families might use multiple vehicles, pay-per-mile car insurance can offer substantial savings for those with lower mileage.

5. Consider Specialized Coverage

Some specialized insurance options might offer savings:

- Low-mileage car insurance: If a vehicle is not used often, this type of policy could be more affordable.

- Electric car insurance: If your family drives electric vehicles, some insurers offer discounts.

- Classic car insurance: For families with classic or vintage cars, specialized insurance can be cheaper.

For example, if you have a classic car in Grand Rapids, classic car insurance might be more economical compared to a standard policy.

6. Look for Additional Discounts

Many insurers offer additional discounts that can further reduce your costs:

- Auto insurance for bad credit: Some insurers offer programs for those with poor credit, potentially offering better rates than others.

- Online auto insurance comparison: Using online tools to compare rates can help you find discounts that are not always advertised.

- Liability-only car insurance: If you drive older vehicles, opting for liability-only car insurance can save you money compared to comprehensive coverage.

In Oklahoma City, where insurance rates can vary widely, utilizing an online auto insurance comparison tool can help you find the most competitive rates.

Practical Examples and Potential Savings

-

Family of Four Vehicles: By combining policies and taking advantage of a multi-vehicle car insurance discount, you could save up to 25% on your total premium.

-

Low-Mileage Vehicles: If you have a car that is driven infrequently, switching to a low-mileage car insurance policy might save you 10-15% on your premium.

-

Senior Citizens: Families with senior drivers can benefit from senior citizen auto insurance, potentially reducing rates by up to 15% compared to standard policies.

-

Teen Drivers: Adding a teen driver to your policy could be less expensive if they maintain good grades and take a driving course, leading to potential savings of 10-20%.

By leveraging these strategies, families can manage their car insurance expenses more effectively while ensuring they receive adequate coverage.

Reducing car insurance costs for families involves a combination of comparing rates, bundling policies, and taking advantage of discounts. Whether you are in Des Moines, Oklahoma City, Lansing, Louisville, or Grand Rapids, these strategies can help you secure the best auto insurance rates while minimizing expenses. By exploring options such as low-cost car insurance, pay-per-mile car insurance, and accident forgiveness auto insurance, you can find the most affordable and suitable coverage for your family's needs.

The Benefits of Low-Cost Car Insurance for New Drivers

If you're a new driver, finding low-cost car insurance can be a game-changer. Young or inexperienced drivers often face higher premiums due to their perceived risk. However, there are effective strategies to save on car insurance quotes online while ensuring you have the coverage you need. This blog post will explore how new drivers can benefit from cheap car insurance, including tips on qualifying for discounts and avoiding common pitfalls.

Understanding the Basics of Car Insurance

Before diving into how to save money, it’s essential to understand what car insurance is and why it’s necessary. Car insurance protects you financially in case of an accident, theft, or damage to your vehicle. It also covers liability if you cause injury or damage to others. For new drivers, understanding these basics can help you make informed decisions about your policy.

Benefits of Low-Cost Car Insurance for New Drivers

-

Affordability: The most apparent benefit of low-cost car insurance is the affordability it offers. Young drivers, often on a tight budget, can find cheap car insurance for new drivers that fits their financial situation without sacrificing essential coverage.

-

Financial Security: Even if you're saving money, you don’t have to compromise on full coverage auto insurance. Affordable plans can still provide comprehensive auto insurance and collision coverage to protect you from unexpected costs.

-

Flexibility: Many providers offer temporary car insurance or pay-per-mile car insurance options, which can be advantageous if you don't drive frequently or need coverage for a short period.

-

Improved Driving Habits: Some low-cost car insurance plans come with programs that track your driving habits. This can lead to discounts for safe driving, encouraging you to adopt better driving behaviors.

Tips for Finding the Best Auto Insurance Rates

-

Compare Car Insurance Rates: Use online tools to compare car insurance rates from multiple providers. Websites that offer online auto insurance comparison can help you find the best auto insurance rates based on your driving history and vehicle type.

-

Consider a Higher Deductible: Opting for a higher deductible can lower your monthly premium. Just ensure you have enough savings to cover the deductible if you need to make a claim.

-

Explore Discounts: Look for auto insurance discounts that might apply to you. Many insurers offer discounts for factors like having a good academic record, completing a driver’s education course, or bundling with other policies.

-

Look into Multi-Vehicle Discounts: If your family has multiple cars, consider a multi-vehicle car insurance discount. Insuring more than one vehicle with the same provider can lead to significant savings.

-

Leverage Low-Mileage Discounts: If you don’t drive frequently, look for low-mileage car insurance options. These policies often come with lower premiums for drivers who put fewer miles on their cars.

-

Check for SR-22 Requirements: If you have a troubled driving record, you might need an SR-22 to prove financial responsibility. Look for providers offering SR-22 insurance as part of their coverage.

-

Consider Non-Owner Car Insurance: If you don’t own a car but drive occasionally, non-owner car insurance policy can be a cost-effective option.

-

Evaluate Coverage Options: Decide if you need comprehensive auto insurance or if liability-only car insurance suffices. Liability-only insurance is typically cheaper but doesn’t cover your vehicle's damage.

How to Qualify for Discounts

-

Good Driving Record: Maintain a clean driving record to qualify for accident forgiveness auto insurance and other discounts. Avoiding accidents and traffic violations can significantly reduce your premiums.

-

Driver’s Education: Completing a driver’s education course can make you eligible for discounts on teen car insurance quotes and car insurance for young drivers.

-

Military Discounts: If you’re in the military, look for auto insurance discounts for military personnel. Many insurers offer special rates for service members.

-

Good Student Discounts: If you're a student, some insurers offer discounts for maintaining good grades. This is often applied to teen car insurance quotes and can lower your overall cost.

-

Bundling Policies: Combine your auto insurance with other policies like homeowners or renters insurance to receive cheapest car insurance rates through bundling.

Common Pitfalls to Avoid

-

Underestimating Coverage Needs: While saving money is crucial, don’t compromise on necessary coverage. Ensure your policy includes sufficient liability-only car insurance if that’s your choice, or full coverage auto insurance if needed.

-

Ignoring the Fine Print: Always read the terms and conditions of your policy. Some cheap car insurance for new drivers may come with exclusions or limitations that could leave you underinsured.

-

Not Reviewing Your Policy Regularly: As your driving habits or life circumstances change, revisit your policy. You might qualify for new discounts or need to adjust your coverage.

-

Overlooking Payment Options: Some insurers offer no deposit car insurance or no down payment auto insurance, which can help manage your budget better. Explore these options if upfront costs are a concern.

Insurance Options in Specific Cities

- Louisville: For new drivers in Louisville, comparing car insurance quotes online can help find the best rates tailored to local requirements.

- Grand Rapids: In Grand Rapids, look into low-cost car insurance options that might include discounts for safe driving or low mileage.

- Oklahoma City: Accident forgiveness auto insurance can be beneficial for young drivers in Oklahoma City, where road conditions can vary.

- Lansing: Teen car insurance quotes and cheap car insurance for new drivers in Lansing often come with discounts for students and safe driving.

- Des Moines: Consider online auto insurance comparison tools in Des Moines to find best auto insurance rates tailored to your needs.

Finding low-cost car insurance as a new driver doesn’t mean you have to skimp on coverage. By comparing car insurance rates, exploring various discounts, and understanding your coverage options, you can secure an affordable policy that meets your needs. Stay informed, drive safely, and make the most of available discounts to keep your insurance costs manageable while protecting yourself on the road.

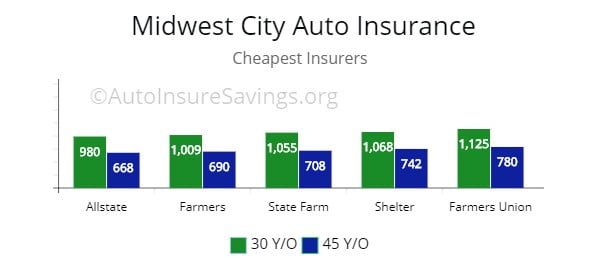

Comprehensive Comparison of Low-Cost Car Insurance Providers in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines

When seeking affordable car insurance, it's crucial to compare providers based on pricing, coverage options, customer reviews, and available discounts. This guide will help you navigate the options in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines, providing a thorough comparison of the best low-cost car insurance providers.

1. Pricing

Louisville

Geico offers competitive best auto insurance rates in Louisville, with low premiums and excellent discounts for safe drivers and military personnel. State Farm is another strong contender, providing reasonable prices and numerous discount opportunities for bundling policies.

Grand Rapids

In Grand Rapids, Progressive stands out with its cheap car insurance for new drivers and high-risk auto insurance options. Farmers Insurance also provides cost-effective plans, especially for those looking to bundle commercial auto insurance with personal coverage.

Oklahoma City

Allstate is known for offering affordable car insurance in Oklahoma City, with comprehensive coverage options and robust customer service. Esurance, a subsidiary of Allstate, provides competitive rates for those who prefer managing their policies online.

Lansing

In Lansing, The Hartford provides attractive low-mileage car insurance rates and pay-per-mile car insurance plans, ideal for those who drive infrequently. Nationwide also offers good value with a range of discounts, including those for multi-vehicle car insurance.

Des Moines

American Family Insurance is well-regarded in Des Moines for offering no down payment auto insurance and no deposit car insurance options. Travelers Insurance also provides strong value with its full coverage auto insurance and low-cost car insurance plans.

2. Coverage Options

Louisville

Geico and State Farm both provide extensive full coverage auto insurance options, including accident forgiveness auto insurance. For classic car insurance and electric car insurance, Hagerty is a recommended provider in Louisville.

Grand Rapids

Progressive is noted for its comprehensive coverage options, including SR-22 insurance for those needing it. Farmers Insurance offers comprehensive auto insurance that can be tailored to individual needs, including liability-only car insurance and no-fault car insurance.

Oklahoma City

Allstate and Esurance both offer extensive coverage options, including non-owner car insurance policy and temporary car insurance. Mercury Insurance also provides cheapest car insurance with options for auto insurance for bad credit.

Lansing

The Hartford is known for its flexible coverage options, including pay-per-mile car insurance and low-mileage car insurance. Nationwide provides a range of coverage plans, including accident forgiveness auto insurance and senior citizen auto insurance.

Des Moines

American Family Insurance excels with its commercial auto insurance and full coverage auto insurance options. Travelers Insurance offers comprehensive auto insurance with various discounts, including for low-mileage car insurance.

3. Customer Reviews

Louisville

Geico and State Farm are consistently praised for their customer service and claim handling. Geico receives high marks for its user-friendly online tools, while State Farm is recognized for personalized customer service.

Grand Rapids

Progressive receives positive reviews for its innovative tools and competitive pricing, though some customers note higher premiums for high-risk drivers. Farmers Insurance is commended for its knowledgeable agents and comprehensive coverage options.

Oklahoma City

Allstate has a solid reputation for customer service and claims support. Esurance is favored for its straightforward online experience, though some reviews suggest occasional delays in claims processing.

Lansing

The Hartford is well-regarded for its customer service and specialized coverage for low-mileage drivers. Nationwide also receives positive feedback for its competitive rates and responsive customer support.

Des Moines

American Family Insurance is praised for its flexible coverage options and strong customer service. Travelers Insurance is noted for its comprehensive coverage and effective claims handling.

4. Discount Opportunities

Louisville

Geico offers numerous discounts, including for bundling policies and maintaining a clean driving record. State Farm provides discounts for defensive driving courses and multi-policy bundles.

Grand Rapids

Progressive has a variety of discounts, including for pay-per-mile car insurance and multi-vehicle car insurance. Farmers Insurance offers discounts for safe driving and vehicle safety features.

Oklahoma City

Allstate provides discounts for safe driving, bundling policies, and setting up automatic payments. Esurance offers competitive discounts for low-mileage car insurance and online auto insurance comparison.

Lansing

The Hartford has discounts for low-mileage drivers and safe driving. Nationwide offers savings for bundling policies and maintaining a clean driving record.

Des Moines

American Family Insurance offers discounts for bundling policies and low-mileage driving. Travelers Insurance provides savings for multi-vehicle car insurance and auto insurance discounts for military personnel.

Recommendations for the Best Value for Money

Louisville

For the best overall value, Geico is recommended for its competitive pricing and extensive discounts. State Farm is also a strong choice for those seeking personalized service and comprehensive coverage.

Grand Rapids

Progressive is ideal for new drivers and those needing high-risk auto insurance. Farmers Insurance offers good value for those looking to bundle commercial auto insurance with personal coverage.

Oklahoma City

Allstate provides excellent value with a wide range of coverage options and robust customer service. Esurance is a good choice for those who prefer managing their policies online.

Lansing

The Hartford is recommended for its flexible coverage options and discounts for low-mileage drivers. Nationwide is also a strong choice for its comprehensive coverage and competitive rates.

Des Moines

American Family Insurance offers great value with its no down payment auto insurance and flexible coverage options. Travelers Insurance provides competitive pricing and comprehensive coverage options.

When looking for low-cost car insurance in Louisville, Grand Rapids, Oklahoma City, Lansing, and Des Moines, it's essential to compare different providers based on pricing, coverage options, customer reviews, and available discounts. By evaluating these factors, you can find the best value for your money and secure the coverage that meets your needs.

The Impact of Driving Habits on Low-Cost Car Insurance Rates

When it comes to managing car insurance costs, your driving habits play a crucial role. Factors such as safe driving, low mileage, and regular vehicle maintenance can significantly influence your insurance premiums. In this article, we’ll explore how these factors affect low-cost car insurance rates and provide practical tips for improving your driving habits to qualify for better rates.

Safe Driving and Insurance Premiums

One of the most influential factors in determining your car insurance rates is your driving record. Safe driving habits can lead to substantial savings on your premiums. Insurance companies often reward drivers who demonstrate a history of responsible driving with lower rates. This is because a clean driving record signifies a lower risk of accidents, which in turn reduces the insurer's potential payout.

Accident forgiveness auto insurance is a popular option for drivers who want to protect their rates in the event of a minor mishap. While this coverage doesn’t prevent your rates from increasing indefinitely, it can help you avoid immediate premium hikes after your first accident.

To maintain a clean driving record, follow these tips:

- Adhere to speed limits: Excessive speeding is a leading cause of accidents and traffic violations.

- Avoid distractions: Stay focused on the road and avoid using your phone while driving.

- Practice defensive driving: Anticipate the actions of other drivers and be prepared to react safely.

Low Mileage and Insurance Costs

Low-mileage car insurance is another effective way to reduce your premiums. Insurance companies often view drivers with lower annual mileage as less risky because they spend less time on the road, reducing the likelihood of an accident. If you drive less than the average person, you may qualify for special low-mileage car insurance rates.

To make the most of this opportunity, consider the following:

- Track your mileage: Keep a log or use a mileage tracking app to monitor your driving habits.

- Opt for pay-per-mile car insurance: Some insurers offer this type of policy, which charges you based on the miles you drive. This can be particularly beneficial if you have a short commute or use your car infrequently.

Vehicle Maintenance and Insurance Premiums

Regular vehicle maintenance is essential not only for your safety but also for keeping your insurance rates low. A well-maintained vehicle is less likely to break down or be involved in an accident, making it a lower risk for insurers.

Here are some maintenance tips that can positively impact your insurance rates:

- Perform regular check-ups: Schedule routine maintenance and address any issues promptly.

- Keep your vehicle in good condition: Ensure that all safety features, such as brakes and lights, are functioning properly.

- Use quality parts: Investing in high-quality replacement parts can improve your vehicle’s performance and safety.

Comparing Insurance Rates and Finding Discounts

To get the best auto insurance rates, it's crucial to compare car insurance rates from different providers. Shopping around allows you to find the most affordable coverage that meets your needs. Many factors affect your rates, including your driving habits, location, and the type of coverage you choose.

Here’s how you can find the best rates:

- Use online auto insurance comparison tools: Websites and apps can help you quickly compare rates from multiple insurers.

- Look for discounts: Many insurance companies offer discounts for various reasons, such as having a clean driving record, bundling policies, or being a good student.

Additionally, car insurance quotes online can give you a snapshot of potential costs. For new drivers, cheap car insurance for new drivers is available but often requires careful consideration of policy features and coverage.

Tips for Improving Driving Habits

Improving your driving habits not only enhances your safety but also helps you qualify for lower insurance rates. Here are some practical tips to help you drive more safely and potentially reduce your premiums:

- Enroll in a defensive driving course: Completing a recognized course can sometimes qualify you for discounts and improve your driving skills.

- Reduce your driving speed: Obeying speed limits and avoiding rapid acceleration can lower your risk of accidents.

- Avoid hard braking: Smooth and gradual braking reduces the wear and tear on your vehicle and lowers your risk of collisions.

- Plan your routes: Efficient route planning can help you avoid traffic and reduce your time on the road.

Types of Car Insurance Coverage to Consider

Choosing the right type of coverage is essential for finding cheap car insurance while ensuring adequate protection. Here are some types of coverage to consider:

- Full coverage auto insurance: This includes liability, collision, and comprehensive coverage, offering comprehensive protection.

- Liability-only car insurance: This is typically less expensive but only covers damages to others in an accident you cause.

- Commercial auto insurance: For vehicles used for business purposes, this coverage is essential to protect against work-related risks.

- Temporary car insurance: Ideal for short-term use, this type of coverage provides protection for a limited period.

For those with specific needs, classic car insurance and electric car insurance offer tailored coverage options. Additionally, if you have a high-risk driving history, you might need high-risk auto insurance or SR-22 insurance to meet state requirements.

Your driving habits play a significant role in determining your low-cost car insurance rates. By practicing safe driving, reducing your mileage, and maintaining your vehicle, you can lower your premiums and ensure you’re getting the best value for your insurance.

Whether you’re in Louisville, Grand Rapids, Oklahoma City, Lansing, or Des Moines, understanding how your driving habits impact your insurance costs can help you make informed decisions and potentially save money. Take advantage of online tools to compare car insurance rates and explore various policy options to find the best coverage for your needs.

What's Your Reaction?